Choosing the right bank and understanding your banking options is crucial for anyone looking to save and invest their money wisely. In this guide, we will delve into the various types of bank accounts, investment opportunities, and financial planning strategies to help you grow your wealth effectively.

Savings Accounts

A savings account is a simple way to save money while earning interest. Most banks offer various savings accounts with different interest rates and minimum balance requirements. Look for high-yield savings accounts to maximize your earnings.

Checking Accounts

Checking accounts are used for daily transactions. They offer easy access to your funds for expenses and come with debit cards and check-writing capabilities. Make sure to compare different accounts to find the one with minimal fees and the best features.

Certificates of Deposit (CDs)

CDs are time deposits that offer higher interest rates in exchange for keeping your money locked in for a set term. This is a great option if you can afford to keep your money untouched for a while and want a guaranteed return.

Money Market Accounts

These accounts typically offer higher interest rates than traditional savings accounts but may require a higher minimum balance. They combine features of both savings and checking accounts, often providing check-writing privileges.

Credit Unions

Credit unions are member-owned financial institutions that can offer better rates and lower fees compared to traditional banks. They often focus on community service and may provide personalized financial advice.

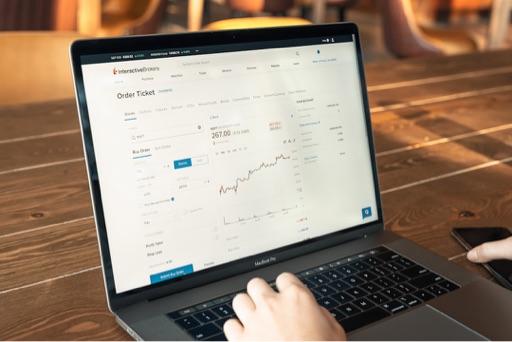

Investing Strategy

It’s essential to have an investing strategy in place. Consider diversifying your investments across stocks, bonds, and other assets to mitigate risks. Start small if you’re a beginner, and gradually expand your portfolio as you learn more about different investment vehicles.

Finding a Financial Planner

A financial planner can help guide you in your financial journey. Look for a certified planner who understands your goals and can help tailor a plan to meet them. Don’t hesitate to ask about their fee structure, and ensure their services align with your financial needs.

Taxes and financial planning

Understanding taxes is an integral part of financial planning. Being aware of tax brackets, filing deadlines, and deductions can save you significant money. Make sure to consult tax experts to navigate complex tax laws and maximize your returns.

In conclusion, whether you’re opening a bank account, considering various investment options, or planning your financial future, it is essential to stay informed and make educated decisions. Regularly reviewing your financial goals and assessing your progress toward them is key to securing a prosperous future.

Source: GOBankingRates